Do you want to create a virtual foreign bank account to receive payments online? Freelancers and remote workers face a major challenge in receiving payments from foreign clients and employers.

With a virtual account, you can receive transfers from anywhere and anyone, just like you would on a normal bank account.

In this article, we’ll review the best platforms to get a virtual foreign bank account from any country.

Content:

- Benefits of Using a Virtual Foreign Bank Account

- Best Virtual Foreign Bank Account Providers

- Frequently Asked Questions

- Conclusion

Benefits of Using a Virtual Foreign Bank Account

There are several benefits to using a virtual foreign bank account, some of them include:

- The ability to transfer money internationally and open foreign currency accounts.

- Ability to make and receive payments in multiple currencies, making it easier to conduct international business.

- Compared to traditional banks, better exchange rates and lower fees are possible.

- Anonymity and privacy as it doesn’t require physical presence.

- Increased flexibility for people who frequently travel or live abroad.

Best Virtual Foreign Bank Account Providers

Below we’ve outlined the best foreign account providers to help you send and receive money globally.

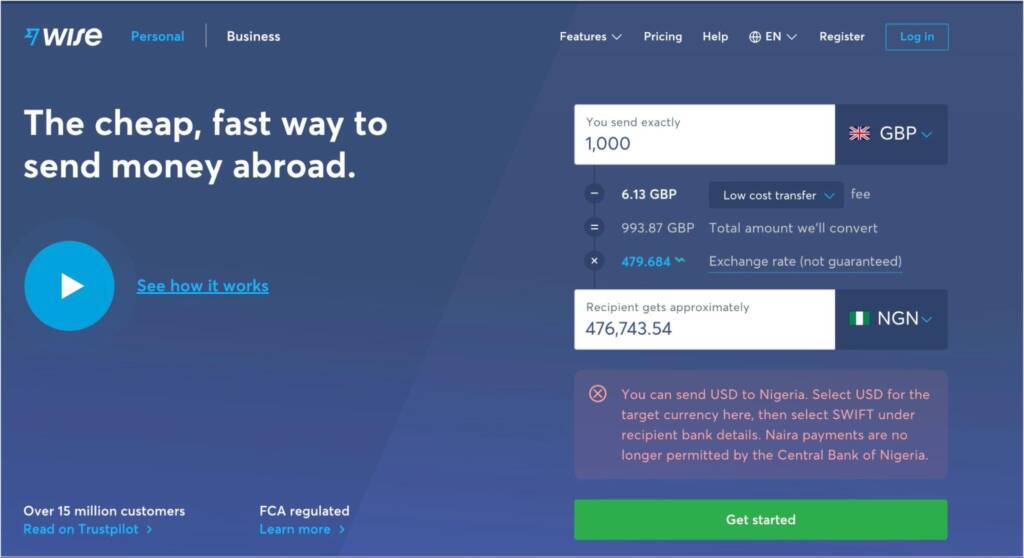

Wise (Formally TransferWise)

Wise is a fintech company that offers a peer-to-peer money transfer service. It allows users to send and receive money at a lower cost than traditional banks. The company uses a hybrid business model, which includes both a marketplace platform and a traditional financial institution.

Key Features:

- Offers virtual bank accounts in multiple currencies, including EUR, GBP, and USD

- Competitive exchange rates

- Option to send and receive payments via bank transfer or debit/credit card

- Easy integration with websites and mobile apps

- User-friendly dashboard for tracking and managing transactions

KYC Requirements

Before using this app, you’ll need to complete a basic KYC (Know Your Customer) verification. This can include uploading address verification documents, a passport, and a valid ID card.

Note: You can only use an ID card with an expiry date, such as your driver’s license or international passport, for ID verification.

Payoneer

Payoneer is another payment platform that offers businesses and individuals a range of payment and financial services. The company was founded in 2005 and is based in New York, US.

They offer cross-border payments, prepaid debit cards, and currency exchange. Payoneer caters to a global market and aims to make it easy for anyone to access financial services regardless of location.

Key Features:

- They provide virtual bank accounts in various currencies, including EUR, GBP, and USD

- Ability to receive payments from over 200 countries

- Competitive exchange rates

- 24/7 customer support

- Option to choose between personal and business accounts

- They provide prepaid dollar cards to assist in making online purchases.

KYC Requirements

Before using this platform, you’ll need to complete a basic KYC verification. This can include uploading address verification documents, a passport, and a valid ID card.

Sidenote: You can only use an ID card with an expiry date for the verification. ID cards such as your driver’s license or international passport.

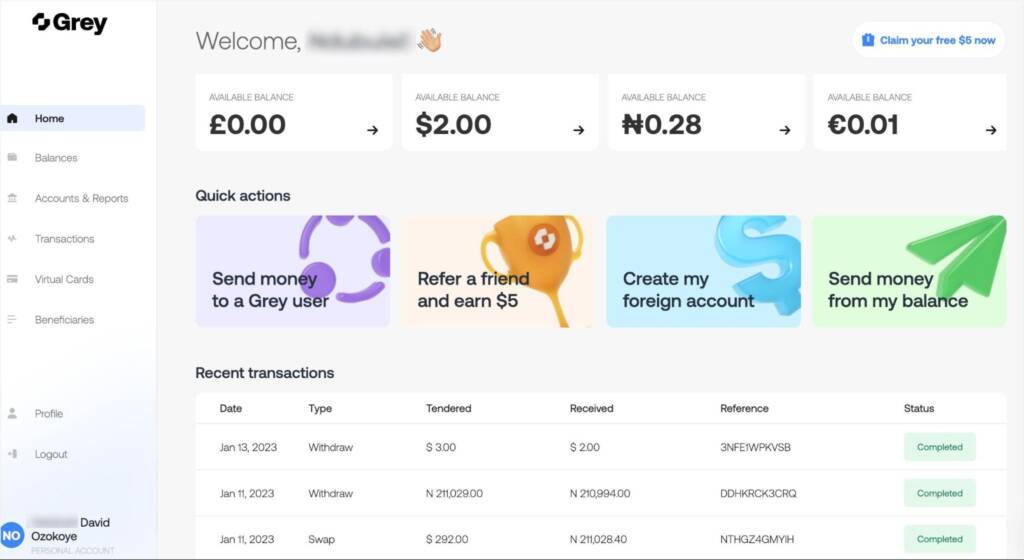

Grey.co (Formally Aboki.Africa)

Grey.co is a fintech startup that allows users to send and receive international transfers globally. The company was founded in 2018 and is based in London, UK. Grey.co offers free USD, GBP, and EUR accounts to receive payments from any country worldwide.

With Grey.co, you can also create a virtual dollar card for making online payments. Another cool feature about using Grey is that they have low transaction fees.

Key Features

- They provide virtual bank accounts in various currencies, including EUR, GBP, and USD

- Ability to receive payments from over 200 countries and territories

- Competitive exchange rates

- 24/7 customer support

- They provide virtual dollar cards to assist in making online purchases.

KYC Requirements

Before using this platform, you’ll need to complete a basic KYC verification. And this can include uploading address verification documents, a passport, and a valid ID card.

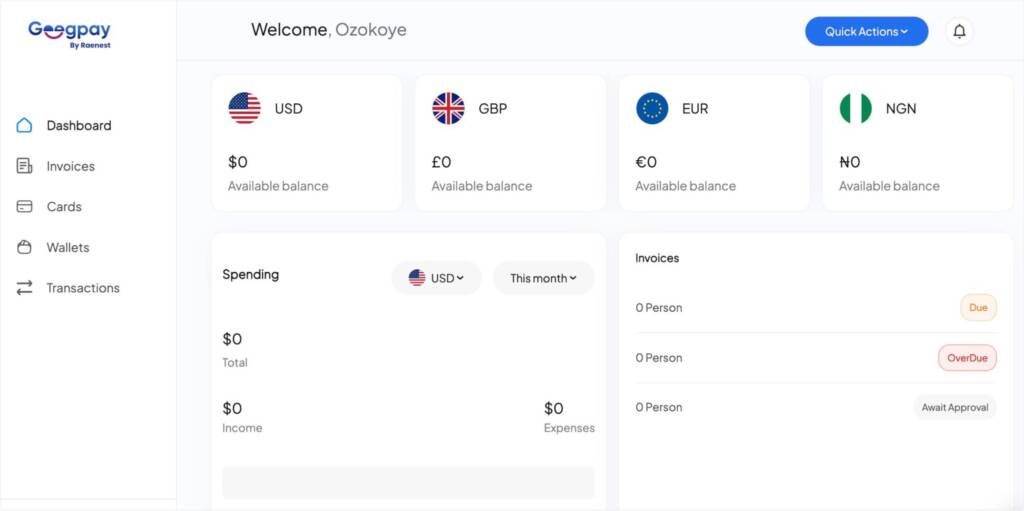

Geegpay – Virtual Foreign Bank Account

Geegpay is a fintech startup that offers a payment gateway to send and receive payments online. The company was founded in 2020 and is based in London, UK.

Geegpay aims to make it easy for businesses to accept online payments and manage their finances. The company offers various services, including payment processing, invoicing, and fraud protection.

Features

- Provides virtual bank accounts in multiple currencies, including EUR, GBP, and USD

- Supports multiple payment methods, including bank transfer, debit/credit card, and e-wallet

- It allows you to automatically send invoices to your employers

- They provide advanced security features, including fingerprint authentication and 2FA

- Provides virtual dollar cards for making online payments.

Recommended: How to open and verify your Geegpay account

KYC Requirements

Before using this app, you’ll need to complete a basic KYC identification. This can include uploading address verification documents, a passport, and a valid ID card.

PayDay – Virtual Foreign Bank Account

PayDay is a fintech company that provides a means to send and receive money worldwide. The company was founded in 2020 with offices in the US and Rwanda. PayDay aims to help people make better financial decisions and access the financial services they need.

With this platform, you can top up your USD account using local bank transfers. Their rate and charges are also considerably lower when compared to other providers.

Key Features

- Offers virtual bank accounts in multiple currencies, including EUR, GBP, and USD

- Supports multiple payment methods, including bank transfer, debit/credit card, and e-wallet

- Advanced security features, including biometric authentication and fraud monitoring

- Provides virtual dollar cards for making online payments.

- User-friendly mobile app for managing your account and tracking transactions.

KYC Requirements

To use this app, you’ll need to complete a basic KYC verification. And this includes uploading address verification documents, a passport, and a valid ID card.

Bonus: PayPal

PayPal is one of the oldest fintech apps in the world. It is an online payment system that allows individuals and businesses to send and receive money online. Paypal operates in over 200 markets and has over 300 million active users worldwide.

As a user, you can link your bank accounts, credit or debit cards to your Paypal account. Then use it to make purchases online or send money to other users. Paypal also offers a variety of business solutions, such as invoicing, accepting payments on a website, and sending and receiving payments in multiple currencies.

One downside to using PayPal is its high transaction fee. There is a fee for sending and receiving money through PayPal. And the fees can be up to 4%.

Features:

- Wide range of payment options, including bank transfer, debit/credit card, and e-wallet

- Option to send invoices and request payments

- Advanced fraud protection

- You can create a personal or business account.

- User-friendly dashboard for tracking and managing transactions

- Direct payment links to receive donations

Frequently Asked Questions

These are answers to some of the top questions users ask about creating a foreign bank account.

How can I get a US bank account in Nigeria / Africa?

There are 2 ways to open a US bank account in Nigeria. You can either open a domiciliary account with any of the local banks in Nigeria. Alternatively, you can create a virtual US bank account using services such as Wise, Grey.co, or Payoneer.

How do I open a virtual bank account?

For this, you’ll need to sign up for an account with a fintech app that provides virtual bank accounts to its users.

What is the best online international bank account?

In terms of popularity and global adoption, Wise and Payoneer are among the oldest and most reliable online foreign bank account providers.

How can I open a virtual bank account in Nigeria?

If you’re in Nigeria, you can easily open a foreign bank account using Grey.co, or Payoneer. All you need is a valid means of identification for their KYC verification. These platforms will provide you with foreign accounts that can receive funds worldwide.

Conclusion

Using a virtual foreign account has some advantages over a domiciliary account. For starters, you’ll have easy access to your funds. And there are no restrictions on the amount of money you can receive.

In this guide, we’ve shared the best 5 virtual foreign bank account providers. All you need is a valid means of identification to complete your registration with any of them.

If you have an international passport, we recommend opting for Wise. This is because they’re affordable and globally accepted. If you don’t have a passport, you can opt for Grey.co, GeegPay, or PayDay. Their verification process is not as strict as Wise and Payoneer.